It has certainly been a rollercoaster year for investors. New Zealand investment firm Forsyth Barr offers an insight into the market.

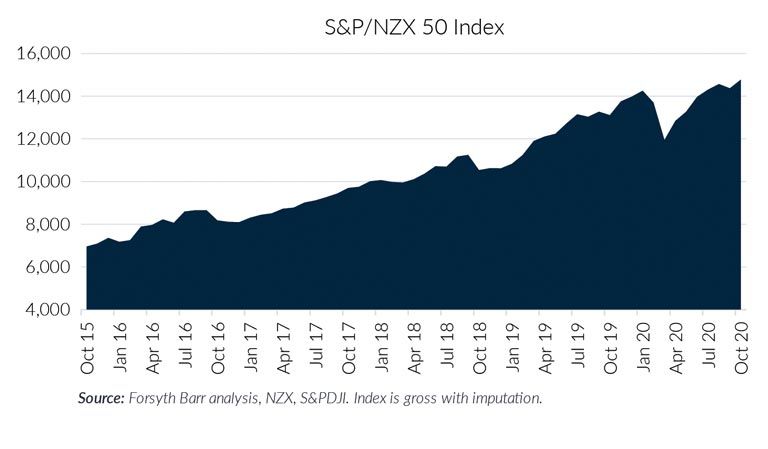

After share markets touched record highs in mid-February, the spread of COVID-19 around the world and the shutting down of economies caused one of the fastest selloffs in history. Then, almost as quickly, on the back of a massive policy response from central banks and governments, markets bounced. Investors who held their nerve have achieved solid returns over the year but, like a rollercoaster, it’s been a scary ride.

Unfortunately, frazzled investors can’t now breathe a sigh of relief and blindly return to what they were doing previously. The impacts of COVID-19 will have ramifications for investment markets for years to come.

Interest rates even lower for longer

Before we’d heard of COVID-19, central banks around the world had been telling us interest rates would remain low for the foreseeable future. Now low interest rates will be even lower.

The cost of COVID-19 for governments has been large and will grow, from the packages to protect businesses and jobs, the stimulus spend to help a recovery after the virus passes, and lost tax revenue. Government debt around the world is forecast to jump to the highest level since the war impacted the 1940s. Back then, repayment of that debt was helped by the baby boom and strong population growth in the decades that followed. Today we face the opposite, the world’s population growth is slowing, and the ageing population means higher pension and healthcare costs for governments.

High government debt levels and the desire to support economic growth will likely firmly ensconce low interest rates as the norm.

Low rates unfortunately means lower returns

Low interest rates has significant implications for investors. Not only will the interest earned from bonds and term deposits be low, but many companies have reduced dividends. Companies are likely to remain cautious given the uncertain outlook. Furthermore, low interest rates have pushed up the prices of assets like shares and property, meaning the future returns from those assets are likely to be lower than what they’ve been in the past.

What’s an investor to do?

This low-return environment will create difficulties for some wanting to live off their savings. Unfortunately, there is no silver bullet solution. The options for an investor depends on individual circumstances. Those who are able to increase allocations to higher-risk/higher-return assets like shares might be able to do so. However, taking more risk should not come with a high chance that an investor can’t meet his or her essential needs – as last February and March reminded us, avoiding ‘sleepless nights’ is valuable. Spending less typically feels unpalatable, but is a low-risk option. For some investors, consuming some capital may be more favourable than bearing increased risk. The majority of investors do not consume all their capital over their lifetime. For many these will not be straightforward questions. We encourage anybody grappling with these issues to seek advice.

For more information or to arrange a no-obligation appointment to discuss your investment objectives in confidence with an Investment Adviser, contact your local Forsyth Barr office by visiting forsythbarr.co.nz/canterbury.

This column is general in nature and should not be regarded as personalised investment advice. Disclosure Statements are available for Forsyth Barr Authorised Financial Advisers on request and free of charge. Fees and charges will apply if you elect to have a continuing relationship with Forsyth Barr.

Recent stories

All Rights Reserved | CountryWide Media